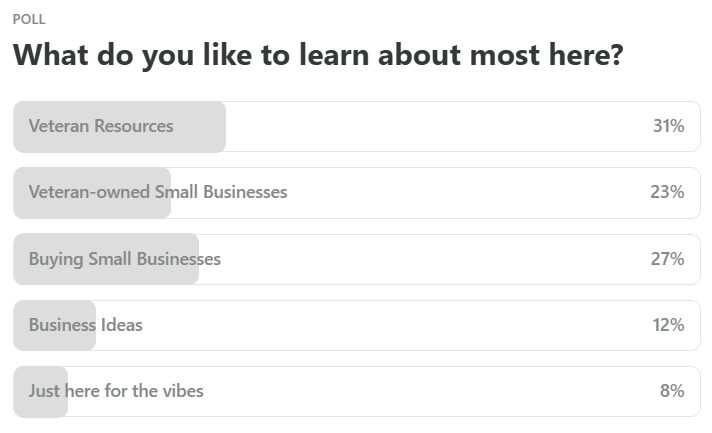

The other week, I asked for feedback on what you all want to see more of.

Here is what I got:

Cool that people like finding veteran-owned small businesses to support. If you want to recommend any, definitely pass them along to me. Just respond to this email or leave a comment.

Wasn’t expecting to see so much about buying small businesses.

In order to meet you all, I will try and share more about buying small businesses.

But let me make things extraordinarily, abundantly clear:

It is not easy.

I’m always reminded of this sign outside Ranger School:

Same goes for buying a small business.

The process of finding a good business for sale is HARD.

Closing a deal is HARD.

And running a business?

HARD.

I’ve seen people make some great money doing this.

And they all say the same thing:

It’s hard.

I also recently had a podcast guest who went bankrupt doing it.

So let me set the record straight:

I am not here to sell a course or act like it is easy.

I spent 9 months under offer on a business before the deal fell apart on the 2-yard line.

It was freaking brutal.

I spent a lot of time and energy on that deal. My wife and I made some big plans and it all fell apart just weeks before my first kid was born.

It sucked.

Do not let any fool you or persuade you that this is easy.

It’s not.

So buckle up if that is what you want to do.

Veteran Business of the Week

Heads up, in this section I will talk about poop.

I have an upcoming podcast with Justin Moore, founder of Agoge Protein and Air Force veteran.

Justin and I connected and set up a call to see if he would be a good fit for the podcast.

I’ll be honest, I kinda rolled my eyes at first.

“Hemp protein?”

But then we started talking, I was sold.

Why?

Because when Justin mentioned how easy this stuff is on your gut, my ears perked up.

Here’s why:

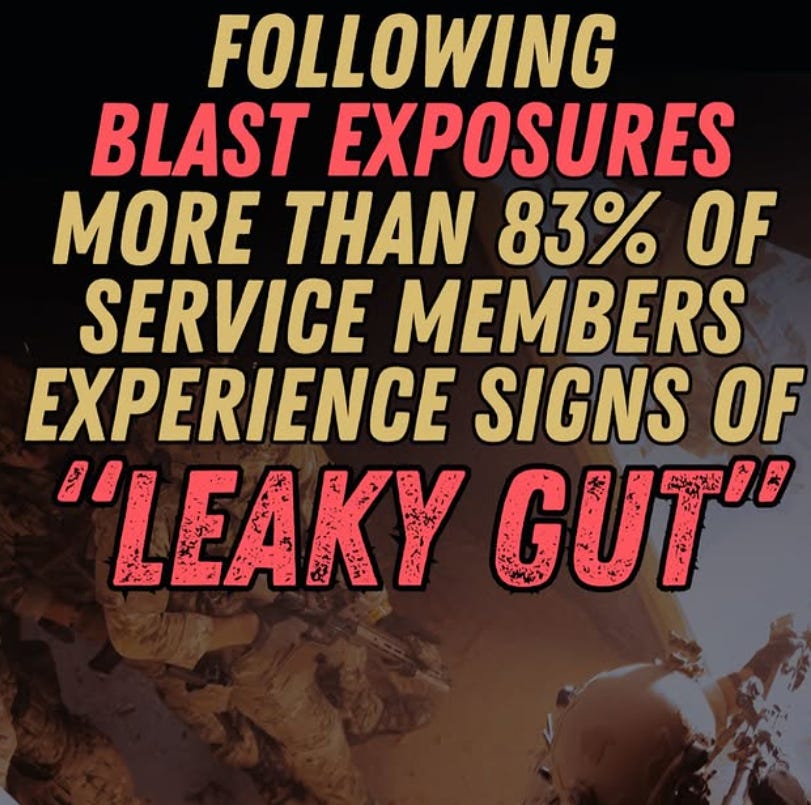

GWOT veterans have a big underlying problem: gut health.

HunterSeven Foundation (more on them later) recently posted this:

Let me tell a quick story:

I was at a BBQ last year with some other veterans, and we were hanging around the grill, talking.

Somehow, someone mentioned having gut issues and then everyone kinda perked up, looked around at each other, and we all realized maybe we all had this.

Look, even if you never got hit by an IED (I didn’t), you likely ate a bunch of MREs, chow hall food, lived near a burn pit, or just ate the local food (the bakery we frequented in Syria definitely kneaded their bread with bare feet).

And so a lot of us got some weird stuff going on in our biome.

So Justin’s protein and its ease on our systems spoke to me.

Is it the American diet? Yeah.

Is it bacteria? Yeah.

Is it some other stuff? Yeah, for sure.

Even if you don’t have gut issues, using clean protein to avoid the infamous protein shake bubble gut seems like a good idea.

So check Agoge out.

Resource of The Week

Ok, so as I mentioned, you should know about HunterSeven.

“HunterSeven Foundation, a veteran-founded, 501(c)(3) organization, conducts research on military exposures among post-9/11 veterans and educates the veteran and healthcare population on critical health information relating to their exposures.”

I’ve always been super impressed with them.

No hidden agenda.

Not an ego project for someone.

Just trying to educate people about the unique health situations of the GWOT generation.

Give them a follow on Instagram and/or donate.

Business Idea

Ok, this is going to be a super fast lesson on buying a business that has government contracts set aside for veterans.

First, the pros:

If they are a business that has the majority of their revenue tied to these contracts, the seller basically HAS to sell to a veteran. So there is (presumably) less competition.

You immediately have a connection with the seller (which is super important) because you are a veteran.

If it is a service business, their contracts are usually 5 years long, which is really great to have.

Ok, now for the challenges:

With the current cuts going on, the forecast on the business is unclear. It COULD mean you get a business at a great deal OR that you get totally screwed.

As mentioned, these businesses do not have a lot of buyers. So when you want to sell, it can be hard to find someone to sell to. That makes it tough also to get investors on board as they want to see you exit in 5-7 years.

Raising investor capital can get really tricky. Without getting too wonky on you, it’s hard to give investors the terms they want and meet the ownership requirements to be eligible for the contracts.

I am only aware of one individual who bought one of these businesses.

How did he raise the money from investors?

He tapped into his veteran network and ONLY raised from veterans.

Ok, this was a SUPER high-level overview, but a good place to get started.

From the Archives

Go crush it,

Mark

Interested in joining a special community just for other high-performing veterans looking to build wealth and their careers? Check out my friend’s Alex’s community, Master the Military HERE.

P.S. This email may have affiliate links.